When comparing solar quotes, out of all of the questions you need answered, the most commonly overlooked one is “Who will own the panels?”. It might seem like a minor detail, but this one choice can dramatically impact how much money you save, who claims the incentives, and how much control you have over the system when the contract ends.

Making the wrong choice could mean leaving tens of thousands of dollars on the table over the lifetime of your panels. Although leasing and owning can appear similar at first glance, the long-term costs and outcomes can vary dramatically.

This guide will uncover everything you need to know to confidently decide if solar ownership is right for you. By the time you finish reading, you’ll have a clear understanding of whether leasing or owning makes the most sense for your home.

Who Gets The Incentives?

One of the biggest reasons solar is so affordable is the incentives that can cover up to 50% of the cost to own your system. Without these incentives, solar power would cost just as much (if not more) than the cost of paying for electricity at current market prices.

When you own your panels, you get access to all of the available incentives through state and federal programs.

- Federal Tax Credit (ITC): At this time, the federal government covers 30% of your solar system cost as a tax credit. But this incentive is given to the system owner. If you lease, the leasing company claims it.

- New York State Tax Credit: New York offers an additional $5,000 personal income tax credit for homeowners. This tax credit can be claimed by homeowners who lease their panels, but it is given over many years.

- NYSERDA Rebates: The NYSERDA upfront rebate can lower your solar cost by as much as $20,000. But when you lease, that rebate is taken by the leasing company.

Leasing companies still advertise solar as being “no upfront cost” because they use these very incentives to finance the system on their end. Then they sell you the electricity the panels produce at a reduced rate when compared to average electricity rates. This means that the leasing company becomes your new electricity provider.

We’re not saying that leasing is bad. Most solar products (even leases) are better for your budget than sticking with your electric company. But if you pay enough income taxes, owning your panels will give you access to tens of thousands of dollars which greatly reduces the cost of ownership.

Long-Term Savings

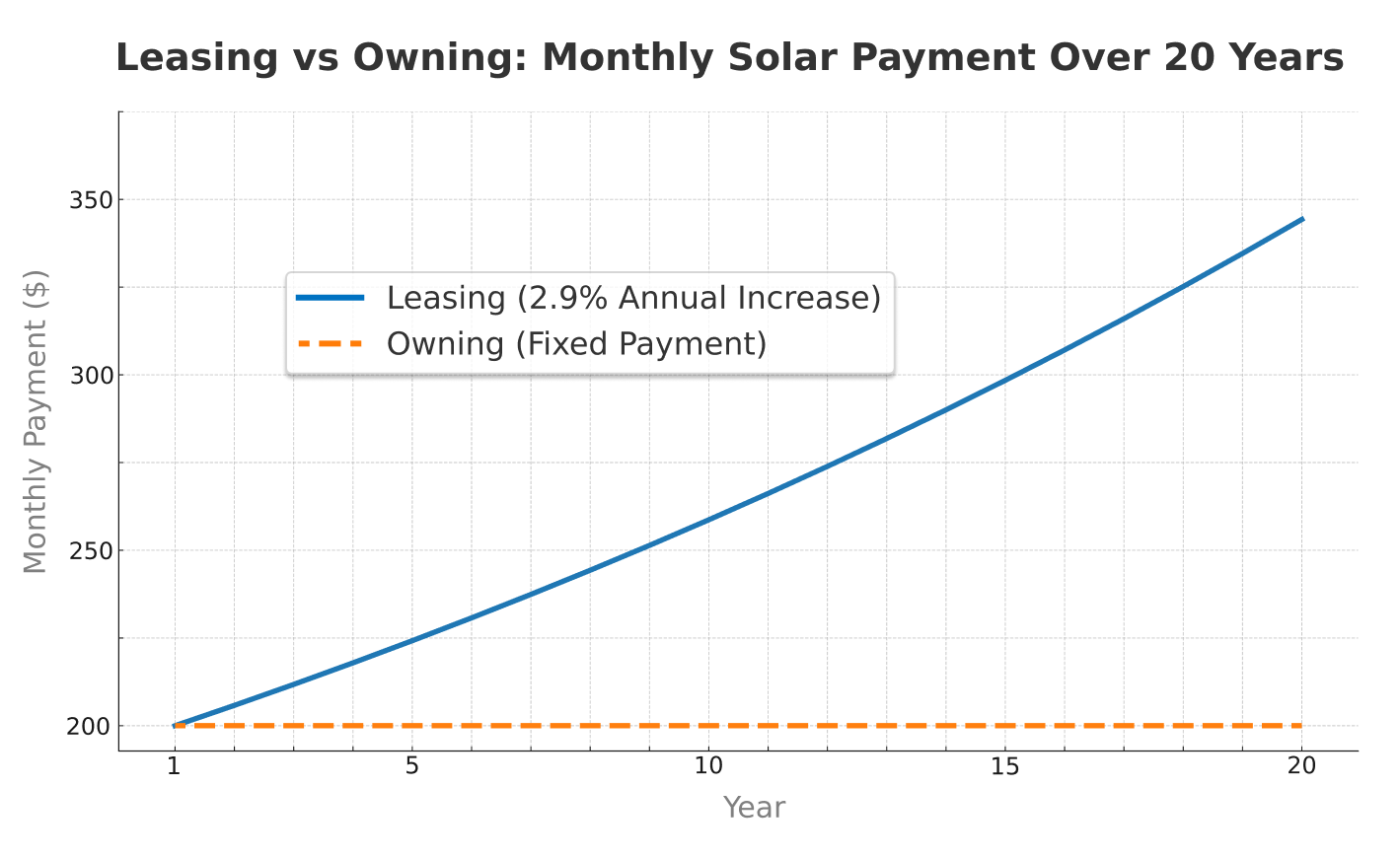

The financial benefits of owning your panels don’t just stop with the tax credits. Ownership almost always wins over time, and the numbers show why. Over the course of 25 years, your savings could look dramatically different when comparing the costs between owning and leasing the same exact system. That’s because built into most leasing agreements is what’s called an escalation clause which allows the leasing company to increase the rate they charge you by 2.9% every year. Although that may seem like a small amount, this will compound to be greater and greater every year and will cause a $200 payment to balloon up to over $350 after 20 years.

When viewing the graph above, it’s important to note that both leasing and ownership payments extend for 20 years. But many New Yorkers will select a 15 year term when they opt to own their panels. This allows you to save more money long term, providing 10 years of free electricity while their 25 year warranty covers any maintenance costs.

The most important thing to understand about leasing is that you’re renting electricity just like when you pay your power company. The leasing company becomes your new “electricity landlord”, while making payments towards owning your energy source builds equity and has an end date. When we run real savings comparisons for homeowners, ownership almost always outpaces leasing by tens of thousands of dollars over 20 to 30 years.

Resale Value of Your Home

The average person moves every 7-10 years. So it’s no surprise that this is an important topic to be considered when comparing leasing against owning your solar panels. According to Zillow, owning your solar panels can increase the value of a home in New York specifically by 5.4%. When considering that the average home in New York is worth about $450,000 that means solar could boost a New York home’s value by as much as $24,300.

Selling a home with owned solar means a reduced cost of living for the incoming home buyer. Think back to when you were buying your current home. Would you have been more inclined to buy your house if it came with a $0 electric bill? When you sell a home with solar panels that you own, the warranty transfers to the next homeowner. That means if you sell your home 10 years after getting solar installed, you’re giving the next homeowner 15 years of free electricity!

Considering that an average 10kW system can provide enough power to knock out a $250 electric bill, 15 years of free electricity would add up to $45,000 in savings over 15 years, and that’s assuming electricity rates stay the same for 15 years.

When you lease your panels you must transfer that lease payment to the buyer of your home. Although taking on a solar lease payment is typically a better option than buying electricity, it can become an unnecessary obstacle to overcome during the sale of your home. This can lead to delays before closing and even last minute negotiations on the price of the home.

When your solar system is fully owned, it becomes an asset and not a liability.

Ownership Has an End Date. Leasing Doesn’t.

As we mentioned briefly before, many New Yorkers select a 15 year term when paying off their panels. This is to save money on interest and because once the system is paid off, they get free electricity.

Most panels are warrantied for 25-30 years which means if your panels are paid for in 15 years, you would still have 10-15 years of worry free savings. This adds up to tens of thousands of dollars saved over time and countless rate increases avoid at the same time.

Leases generally last for 20 years and once that time is up, you need to start all over again under new terms. Some leasing companies will give an option to renew the lease in 5 year increments, but by that time the solar lease payment has risen by nearly 80% since year 1.

The biggest advantage to solar ownership is that there is an end date, where your payments drop to zero and your savings skyrocket. It’s just like owning a home, you’re making payments with the goal that one day, you don’t need to pay anything at all.

When Does Leasing Make Sense?

There really is only one scenario where leasing makes sense over owning your panels, and that’s if you don’t have enough tax liability to claim both the state and federal tax credits. Without these incentives, the initial cost of ownership can be much higher than leasing.

If you’re uncertain what your tax liability is we recommend speaking with a tax professional but a general rule of thumb is those with taxable household income below $55,000/ year may not pay enough income taxes to receive a full tax credit in a single year. It’s important to understand that any unused tax credits will roll over from year to year, so even if you can’t claim a full tax credit your first year, you still have several years to collect the full credit.

Make sure that if you file taxes jointly with someone, that all household income is combined when determining your total taxable income. This includes any income received from rental properties, stocks or any other investments. But if your household taxable income is below $55,000, leasing can be a great way to lock in more predictable energy bills.

At Empire Solar Solutions, we always review your taxable income before recommending any financing structure. But for most qualified homeowners, ownership wins by a wide margin.

Final Thoughts: Why Ownership Wins

Leasing was once a great concept and for a long time, this was the only way to get solar panels installed without paying thousands of dollars up front. But now with flexible financing options, homeowners can pay monthly AND still own their system for less than the cost of leasing.

Here’s what solar ownership gives you:

- Full access to state and federal tax credits

- Fixed or no payments after 10–15 years

- Higher home resale value

- Predictable energy costs and long-term savings

- Complete control over your system and warranties

If you’re considering leasing solar panels, we highly encourage you to get a quote for solar ownership. Both options are identical in many ways, but where they differ can add up to tens of thousands of dollars in savings being lost. Make sure you look at both options and weigh the long-term benefits over the short-term convenience.

To make your decision easier, here’s a side-by-side breakdown of how leasing and owning solar panels compare:

| Leasing | Owning | |

|---|---|---|

| Upfront Cost | $0 | $0 |

| Tax Credits | Claimed by leasing company | You keep all available credits |

| NYSERDA Rebate | Leasing company receives it | Goes directly to you |

| Monthly Payments | Increases ~2.9% annually | Fixed or ends after loan term |

| System Ownership | Leasing company | You own it |

| Home Resale Value | Can complicate sale | Increases value by ~5.4% |

| End of Term | Must renew or remove | No more payments, ongoing savings |

| Long-Term Savings | Moderate | Highest possible savings |

Schedule your free consultation today and let us show you exactly how much you can save by owning your solar system.

GET MY FREE SOLAR SAVINGS PLAN ➞